The wireless mobile industry is ever-changing. We continuously see new technology transforming the landscape, the need to expand into new markets for growth, and the criticality of responding to changes in consumer behavior. Below are just some of the megatrends we see in the industry effecting our industry and device lifecycles.

Megatrend #1: Consumers are holding on to their mobile devices for a LOT longer

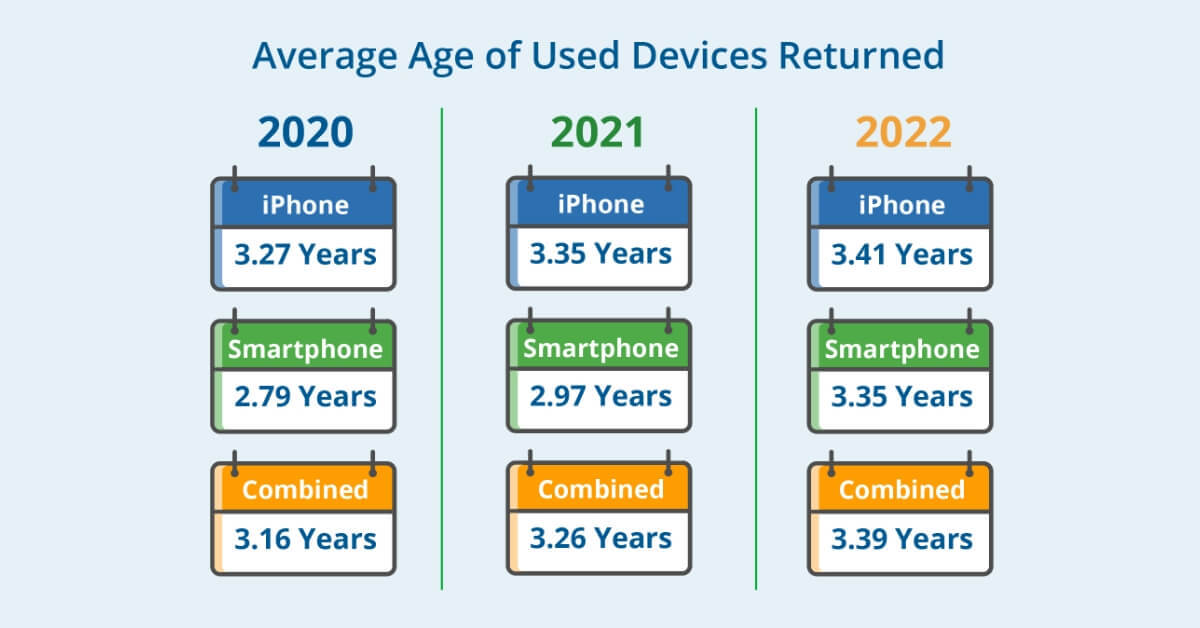

In 2016, consumers were keeping their devices for approximately two years. Since then, the price of a smartphone has increased by 38% and today many exceed $1,000. So not surprisingly, consumers are not upgrading as often as they used to. According to our latest Mobile Trade-in and Upgrade Trends Report we have seen that consumers are now holding on to their devices for over three years.

As consumers keep their devices for longer, the likelihood of experiencing a problem with it increases. Which leads us to Megatrend #2.

Megatrend #2: Device support and repair needs are increasing

A broken phone used to mean that you would often replace it with a new or fully refurbished unit - either through an insurance claim or by purchasing it through a carrier, OEM, or retailer. That is clearly no longer the case. As these devices are now more expensive and consumers do not want even a day without them, they have actively and increasingly embraced device repair instead of replacement.

When we surveyed mobile phone device protection customers, we found they no longer solely look to the carrier channels to solve their problem. We see that they are openly embracing non-carrier owned repair services and that most actually prefer to use these channels for repair today.

However, there seems to be plenty of opportunities for many players in the mobile device repair industry. According to our latest Connected Decade research, 29% of consumers who bought a new device or appliance in the past year chose to buy an extended warranty for it. That figure is even higher for millennials who opted for an extended warranty 46% of the time. Additionally, the global consumer electronics repair and maintenance market is expected to grow from $8.43 billion in 2022 to $8.72 billion in 2023 at a compound annual growth rate (CAGR) of 3.5%.

At some point, though, the consumer will be ready to part with their mobile device and upgrade to a new one. This brings us to our third megatrend.

Megatrend #3: Used device residual value is substantial

Trade-in programs for old devices have become more popular. For consumers, these programs provide an easy, more affordable way to upgrade to a new device. For companies, trade-in programs can be a way to get old devices out of circulation and make room for new devices. They can also be a way to attract new customers.

Overall, trade-in programs are a win-win for both consumers and companies.

The average value of a device traded in has increased by over 70% since 2019 and is now over $200 in the secondary market. Statista estimates that 123 million people in the U.S. will buy a new device this year. It is expected that over 25% of them will trade in their old device resulting in over $6 billion in value through trade-in programs. However, of those 123 million people, 35% of them will keep them where they will end up languishing in a drawer. This equates to $8.6 billion of potential value to capture through trade-in programs.

Not only is the average resale value increased on pre-owned devices, but the demand has also increased. Read on to learn how the refurbished device sales is outpacing new device sales.

Megatrend #4: Pre-owned device sales are EXPLODING

Since 2017 we have seen a steady decline in new smartphone shipments with only one year experiencing an increase – 2021, as stores began to reopen after the pandemic.

Conversely, the sale of refurbished units into North America has steadily risen since 2017 and is expected to continue. In fact, its growth has been outpacing new shipment sales during this time period. In 2017, refurbished units made up only 13% of new and used shipments and by 2025 it is predicted it will make up 38% of shipments.

The pre-owned devices entering the secondary market tend to be good quality units as first owners are taking better care of them, and this has clearly resulted in more people finding used devices an attractive option for themselves.

Our fifth megatrend focuses on the consumer at the point where they are upgrading their device and deciding on trade-in. We need to meet them where they are while providing flexibility and convenience.

Megatrend #5: Consumers now expect Omni-Channel Solutions

The pandemic had accelerated consumers’ attitudes and behaviors about buying just about anything online. And we see that carriers, OEMs and retailers are very much focusing on transforming the way their distribution channels operate and are moving from multi-channel to omni-channel. They aim not only for delivering a consistent and quality experience across channels, but increasingly to provide interoperability across those channels.

When purchasing a new device, consumers want the ability to not just buy in-store but also to buy online and have the option to pick up in-store. They want that same flexibility in conducting a trade; to trade-in a device at the same time when purchasing their phone at a store or online and then dropping off in a store or by mail.

Businesses that fail to respond to this change in consumer behavior risk falling behind, as consumers continue to shift their attention to online channels.

What Drives the Evolution of Mobile Industry Demand?

Consumers are holding on to their devices for longer and therefore we are seeing greater need for protecting the devices that they are so reliant on. When these devices do get traded in, they still have latent value, and there is increased demand for these pre-owned devices around the globe. Trade-in programs are lucrative within the wireless ecosystem, but it starts with the consumer. Collectively, we need to make it as attractive and convenient for the consumer to turn in their device in order to feed the demand we are seeing in the secondary market. These five megatrends are significantly shaping the customer device lifecycle experience and, as a result, our businesses and solutions we offer.

Want to learn more?

Are you a mobile business interested in learning more about our connected device protection, support and service offerings? Click the link to get in touch with our team.