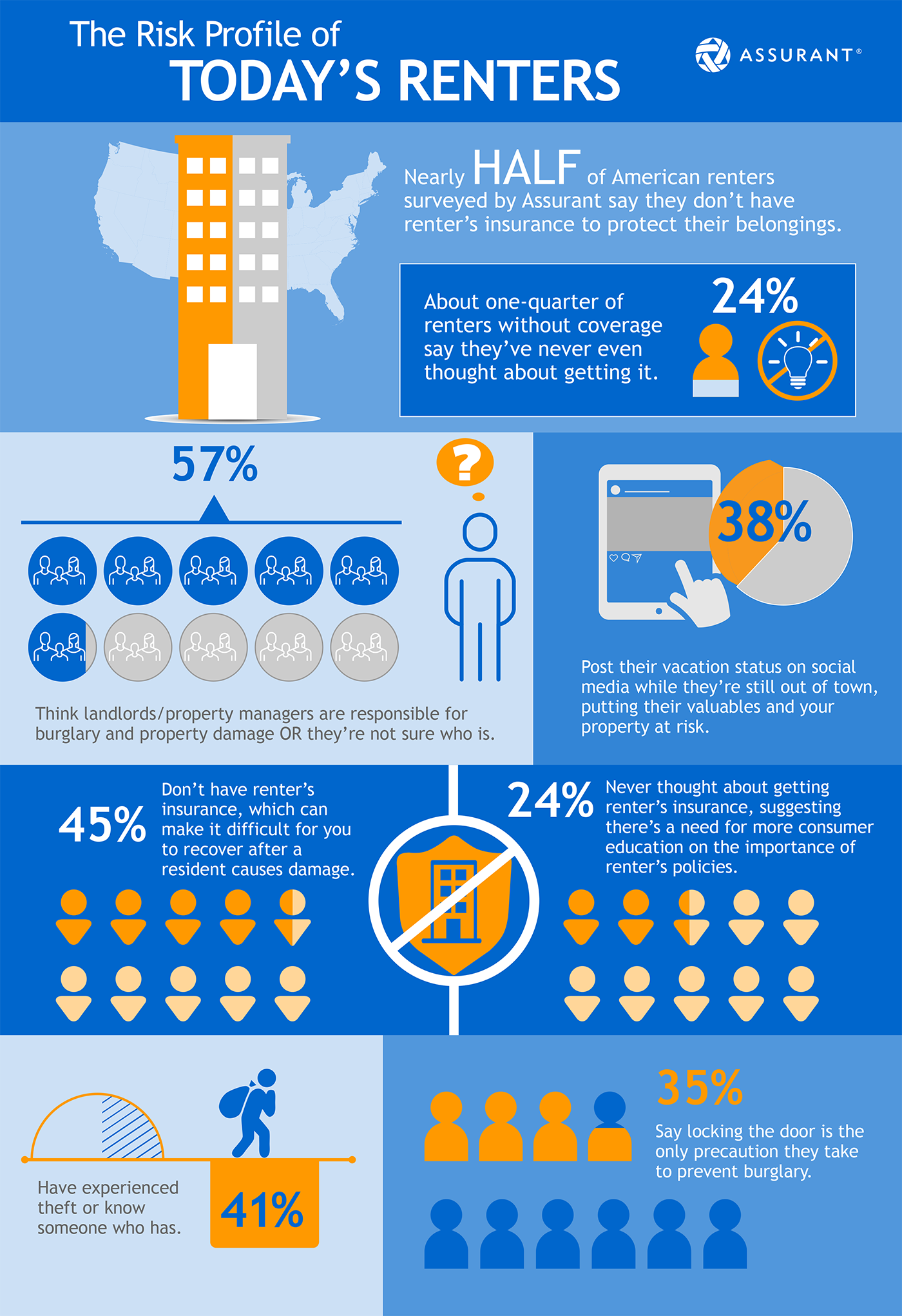

Managing the Impact to Your Property

While responsibility for property damage lies with the renter, unprepared renters can be difficult and costly to collect from when the time comes, and the damages to your property can be in the tens of thousands. The risk that theft or property damages will occur is increased by the fact that modern technology makes it possible for renters to alert their network in real time when they’re out of town and their homes are left unattended. But the good news is there are efficient ways to mitigate your risk.In today’s digital world, putting renter’s insurance in place for your renters and continually tracking their policies to ensure they maintain coverage is a straightforward process. At Assurant, we provide easy-to-use renter’s insurance and tracking that seamlessly integrates into your existing systems.

Learn What Renters Really Want From You

Ask Us For A Free Risk Assessment